Outcome-Based Pricing & Contract Models in Consulting

Align consulting fees with results using outcome-based pricing to drive value and accountability.

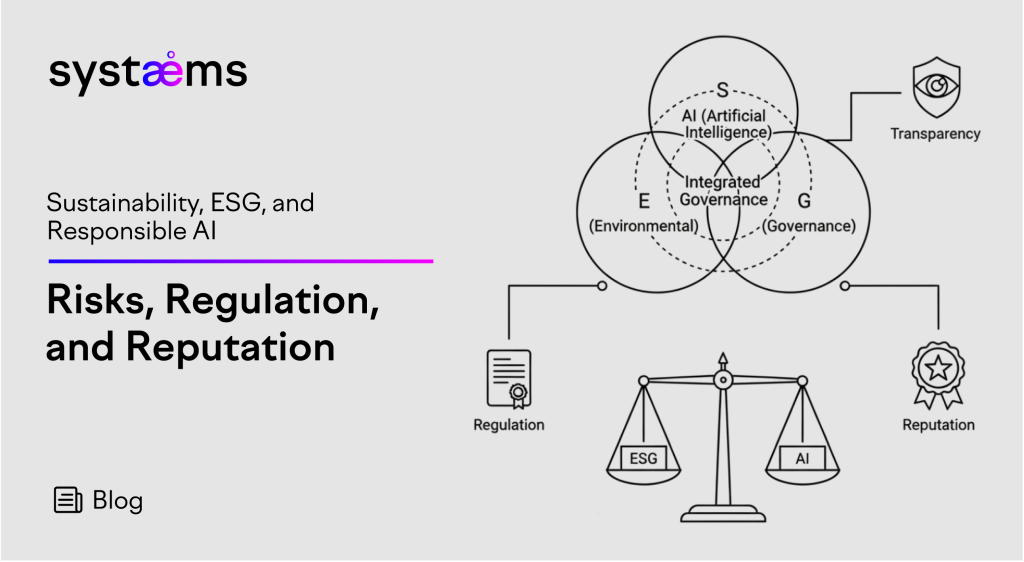

Over the past decade, two transformative forces have shaped the global corporate agenda: Environmental, Social, and Governance (ESG) accountability and the widespread adoption of Artificial Intelligence (AI). Once distinct, these imperatives are now converging as organizations recognize that AI brings not only operational potential but also ethical, regulatory, and reputational complexity.

Just as investors and regulators demand transparency in ESG performance, they are extending the same scrutiny to AI-driven systems. Together, sustainability and responsible AI are becoming the foundation of resilient, trusted, and future-ready enterprises.

At Systaems, we help organizations build integrated ESG and governance frameworks that embed responsible AI principles – enabling compliance, risk mitigation, and long-term stakeholder value creation.

ESG has moved beyond corporate philanthropy to become a strategic necessity for competitiveness and investor confidence. Global expectations have evolved:

Regulatory momentum is accelerating through frameworks such as the EU Corporate Sustainability Reporting Directive (CSRD), the SEC climate disclosure rules, and ISSB sustainability standards. Organizations that fail to operationalize ESG risk facing regulatory penalties, investor withdrawal, and reputational erosion.

To learn how data drives this transformation, see our related article: Leveraging Data Services and KPIs to Drive Organizational Agility.

AI has shifted from a technological enabler to a core strategic force shaping decision-making, customer interaction, and operational intelligence. However, it introduces a new spectrum of governance risks, including:

Responsible AI demands governance-first thinking: transparent algorithms, ethical datasets, and oversight mechanisms comparable to those in ESG reporting.

At Systaems, we assist organizations in building AI risk and governance frameworks that balance innovation with accountability.

Sustainability and AI accountability cannot operate in isolation. Their convergence defines a new paradigm of corporate risk and reputation:

1. Environmental Impact of AI

AI’s computational intensity has a measurable carbon footprint. Large-scale models consume significant energy, challenging corporate sustainability goals. Responsible AI strategies must include digital carbon accounting and efficient infrastructure use aligned with ESG metrics.

2. Social Responsibility

Fairness and inclusion in AI reflect the social dimension of ESG. From hiring algorithms to credit scoring, bias mitigation ensures that technology advances equity rather than inequality. Responsible AI also encompasses reskilling and workforce transition, enabling employees to adapt to automation.

3. Governance and Compliance

Both ESG and AI governance require board-level oversight, transparent reporting, and ethical accountability.

For a practical view of how data governance supports accountability, read Integrating Strategy and Performance Management for Growth.

A global leader in both sustainability and AI governance, Microsoft demonstrates how ESG and AI can be integrated for strategic and ethical advantage.

Microsoft launched its Responsible AI Standard in 2022, introducing company-wide principles for fairness, reliability, safety, and transparency across all AI systems. This initiative operates in tandem with the company’s ESG strategy, which aims for carbon negativity by 2030 and 100 percent renewable energy by 2025.

To operationalize these goals, Microsoft established cross-functional oversight boards that integrate ESG and AI risk reporting into executive performance scorecards. The results are tangible:

This convergence illustrates that responsible AI is not a compliance burden but a reputational asset that simultaneously reinforces trust and drives innovation.

Read more: Microsoft Responsible AI Standard

In our Credit Bureau Cambodia success story, Systaems implemented a data-driven governance framework that improved transparency, trust, and compliance. While the project focused on credit data, the same principles apply to ESG and AI governance: building systems that ensure accountability, regulatory alignment, and stakeholder confidence.

This case demonstrates that embedding responsibility in digital systems strengthens both regulatory compliance and reputation.

Organizations adopting AI and ESG frameworks must proactively manage interlinked risks:

1. Establish Unified Governance Frameworks

Create cross-functional committees to collectively oversee ESG and AI governance. This ensures consistency and accountability across strategic and operational levels.

2. Embed KPIs into Performance Management

Tie ESG and AI metrics to leadership scorecards and performance dashboards. Learn how Systaems’ Performance Management Services can help operationalize this linkage.

3. Leverage Data Services for Transparency

Implement advanced analytics and visualization tools to monitor ESG and AI KPIs in real time. Explore our Data Services to enable transparency and evidence-based reporting.

4. Adopt Global Standards

Align ESG disclosures with GRI and SASB, and AI governance with the EU AI Act and NIST guidelines. Standardization ensures credibility and regulatory resilience.

5. Engage Stakeholders Proactively

Regularly communicate ESG and AI commitments to investors, regulators, and customers. Transparency fosters trust and mitigates misinformation.

In today’s digital economy, corporate reputation is shaped by integrity as much as innovation. Organizations that embed responsible AI within ESG frameworks demonstrate not only compliance but leadership. They:

This integration reflects the essence of the Systaems Strategic Consulting Approach, aligning purpose, performance, and trust to drive sustainable growth.

Sustainability, ESG, and responsible AI are no longer parallel mandates; they are the twin pillars of modern corporate resilience. Together, they define how organizations create value responsibly, mitigate risk intelligently, and sustain reputation credibly.

At Systaems, we help organizations design governance architectures that unite ESG commitments with responsible AI accountability. Whether you are enhancing disclosure readiness, building AI governance systems, or aligning ESG strategy with digital transformation, we can help you turn responsibility into a competitive advantage.

👉 Discover how we can help your organization embed responsible AI and ESG governance: Systaems Services.

Align consulting fees with results using outcome-based pricing to drive value and accountability.

Explore how data, agility, and performance alignment shape the next era of consulting excellence.

Integrate sustainability, ESG, and responsible AI into risk, compliance, and reputation strategies.